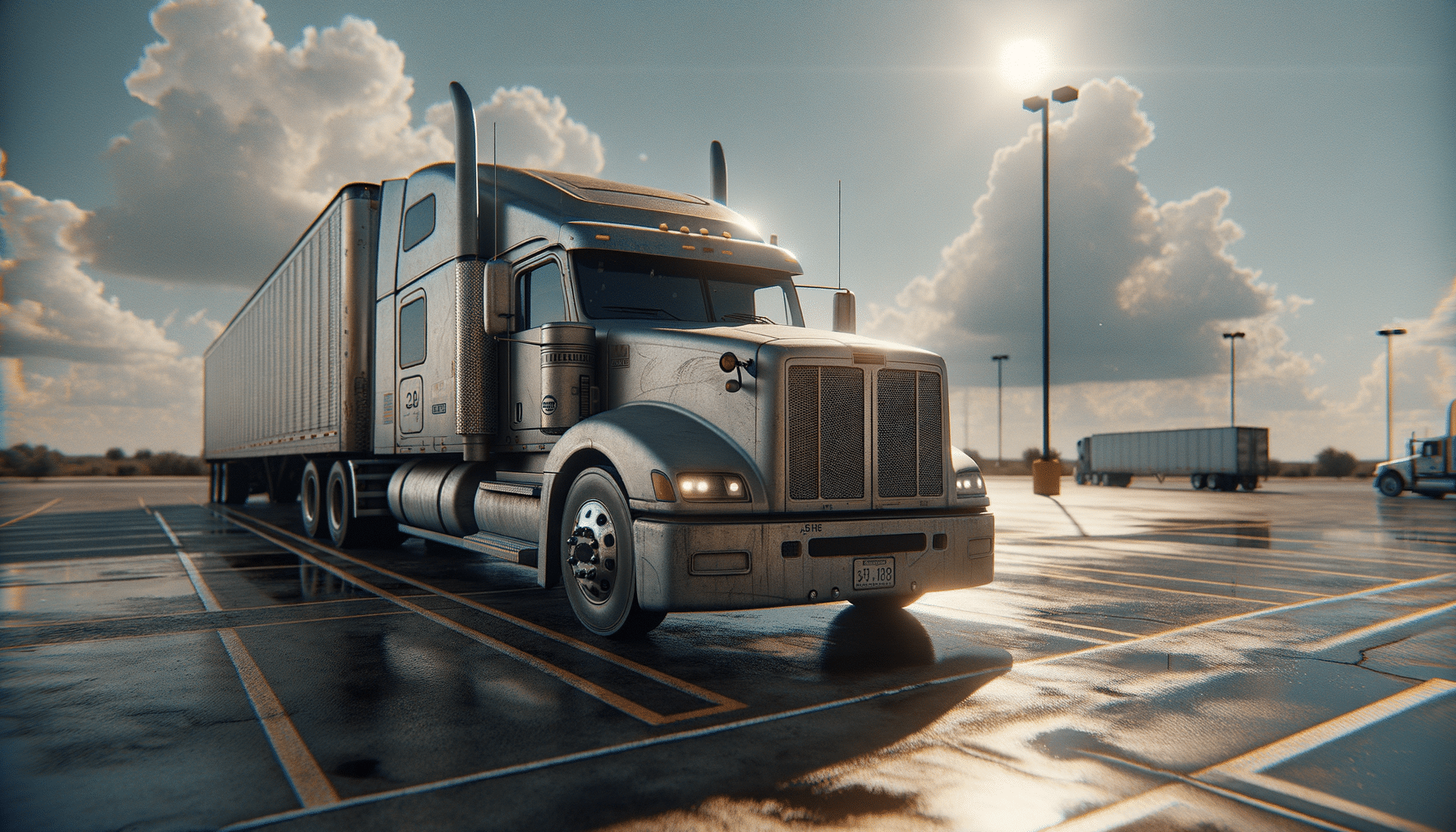

Guide to Leasing a Semi Truck: Options & Insights

Introduction to Semi Truck Leasing

Leasing a semi truck can be a strategic move for drivers and small fleet operators aiming to maintain financial flexibility while avoiding large upfront costs. The decision to lease rather than buy outright can be influenced by several factors including budget constraints, the need for updated technology, and the desire to minimize long-term commitments. With a variety of lease types available, it’s crucial to understand the pros and cons associated with each option. This guide delves into what should be considered before signing a lease, ensuring that you make an informed decision that aligns with your operational needs and financial goals.

Types of Lease Agreements

When it comes to leasing a semi truck, there are several types of agreements to consider. Each type has its own advantages and potential drawbacks, so understanding these can help you choose the most suitable option for your situation:

- Full-Service Lease: This type often includes maintenance and repair services within the lease package, which can save time and reduce hassle for the lessee. However, the monthly payments might be higher due to these added services.

- Lease-Purchase Agreement: Allows you to purchase the truck at the end of the lease term. This can be beneficial if you plan to eventually own the vehicle, but it’s important to consider the total cost of ownership.

- Operating Lease: Typically involves lower monthly payments and is ideal for short-term needs. However, there is no option to purchase the truck at the end of the lease term.

Choosing the right type of lease depends largely on your long-term business goals and current financial situation. Each option offers distinct benefits, and the key is to align these with your operational requirements.

Pros and Cons of Leasing a Semi Truck

Leasing a semi truck offers numerous advantages, but it’s important to weigh these against potential disadvantages:

- Pros:

- Lower Initial Costs: Leasing typically requires less capital upfront than purchasing, freeing up cash flow for other business needs.

- Flexibility: Leasing agreements can be tailored to fit the specific needs of the driver or fleet, allowing for easier upgrades to newer models.

- Maintenance and Repairs: Many leases include maintenance packages, reducing the burden of unexpected repair costs.

- Cons:

- No Ownership: At the end of the lease term, you do not own the vehicle unless you opt for a lease-purchase agreement.

- Potentially Higher Long-Term Costs: Over time, leasing can be more expensive than purchasing if you continually lease new vehicles.

- Restrictions: Lease agreements may have mileage limits and other restrictions that could impact your operations.

Considering these factors can help in deciding whether leasing aligns with your business strategy and financial goals.

Key Factors to Consider Before Leasing

Before signing a lease agreement, several key factors should be evaluated to ensure the decision supports your business objectives:

- Lease Terms: Carefully review the terms and conditions, including mileage limits, maintenance responsibilities, and penalties for early termination.

- Financial Health: Assess your current financial situation to determine if leasing is a viable option. Consider both short-term cash flow and long-term financial commitments.

- Operational Needs: Evaluate whether the lease agreement meets your current and future operational needs, including the type of routes and distance covered.

- Market Trends: Stay informed about industry trends that could impact leasing decisions, such as fuel prices and technological advancements.

Taking the time to thoroughly assess these factors can help prevent unforeseen challenges and ensure that the lease aligns with your strategic goals.

Conclusion: Making an Informed Decision

Leasing a semi truck can be a practical solution for drivers and small fleet operators who wish to maintain flexibility and avoid large upfront costs. By understanding the different types of lease agreements, weighing the pros and cons, and considering key factors before signing a lease, you can make an informed decision that aligns with your business needs. Whether you are looking to expand your fleet or simply upgrade your current vehicle, taking a strategic approach to leasing can help you achieve your operational goals while managing financial risks effectively.